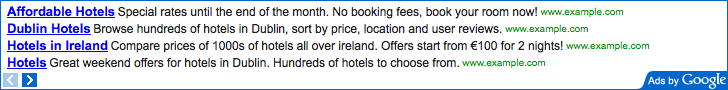

Check out these business banking images:

Bank of America - Take Back the Economy 4-28-09 (36)

Image by seiuhealthcare775nw

Photo Credit: Neil Parekh / SEIU Healthcare 775NW

Seattle Taxpayers Demonstrate at Bank of America as Part of Continued Nationwide Actions to Take Back the Economy

“Taxpayer Proxy” Action Demands Bank Fire CEO Ken Lewis,

Commit to Strong Banking Reform, Voice for Workers

Seattle (April 28, 2009) – Taxpayers, working families and SEIU members joined together in Seattle today and more than 100 other cities across the nation today to take action outside Bank of America branches and collect and deliver “Taxpayer Proxies” demanding the bank fire CEO Ken Lewis and commit to financial reform that puts consumers and workers ahead of profits.

The taxpayer actions took place on the eve of Bank of America’s annual shareholder meeting in Charlotte, NC. After accepting billion in bailout funds, taxpayers and the government are the largest shareholders of Bank of America, and taxpayers in Seattle are demanding that their voices be heard.

On April 29th a delegation of community and national leaders will deliver the “Taxpayer Proxy” demands to the Bank of America shareholder meeting calling on it to: fire CEO Ken Lewis; support strong banking reform; eliminate predatory lending practices and unreasonable fees; support the Employee Free Choice Act to ensure workers have a voice to speak out for consumers and improve working conditions; and provide affordable healthcare to bank workers so they are not forced to rely on tax-payer funded public health programs.

“Taxpayers didn’t cause this economic crisis—but we sure are paying the price," said SanJerra Collins, a caregiver from Tacoma and member of SEIU Healthcare 775NW. “For years, banks have built a business model around pushing dangerous products and burying customers in more and more debt. It’s time for banks to stop these predatory practices and create a system that’s about helping people, not exploiting people.”

Over the last two years, Bank of America CEO Ken Lewis has received .8 million in compensation, while the median wage for a teller at Bank of America hovers around the federal poverty line for a family of four.

Despite receiving billion in federal taxpayer bailout funds since last fall, Bank of America has announced plans to lay off 30,000 to 35,000 workers and handed out .2 million in corporate bonuses. Bank of America could have used the money they paid out in bonuses to give each of its bank tellers an estimated 1,000 raise—nearly seven times their median salary.

The bank also continues to make taxpayers pick up the tab for approximately million a year in employee health care costs because many Bank of America workers cannot afford the company’s health insurance and must rely on public healthcare programs. This costs Washington state taxpayers 9,000 every year.

Last year, Bank of America collected .3 billion in bank fees, almost 30 percent higher than either of its two largest competitors. And even after taking bailout money Bank of America continues running up credit card interest rates on customers even if they have made every payment on time. The bank arbitrarily hiked interest rates on one million play-by-the-rules, pay-on-time customers in 2007 alone.

In 2008, Bank of America spent over million on lobbying and opposed bills like the Employee Free Choice Act, the Credit Cardholders Bill of Rights and the Foreclosure Prevention Act which would directly benefit the economy and consumers.

For more information, please visit www.TakeBackTheEconomy.org.

###

SEIU Locals in Washington State

include:

SEIU Local 6 – representing 3,500 janitors and security guards

SEIU Local 49 – representing 1,200 health care workers in SW Washington

SEIU Healthcare 775NW – representing 35,000 long-term care workers

SEIU 925 – representing 23,000 education and child care workers

SEIU Healthcare 1199NW – representing 22,000 nurses and healthcare workers

SEIU Local 1948 – representing 27,000 school employees

Bank of America - Take Back the Economy 4-28-09 (12)

Image by seiuhealthcare775nw

Photo Credit: Neil Parekh / SEIU Healthcare 775NW

Seattle Taxpayers Demonstrate at Bank of America as Part of Continued Nationwide Actions to Take Back the Economy

“Taxpayer Proxy” Action Demands Bank Fire CEO Ken Lewis,

Commit to Strong Banking Reform, Voice for Workers

Seattle (April 28, 2009) – Taxpayers, working families and SEIU members joined together in Seattle today and more than 100 other cities across the nation today to take action outside Bank of America branches and collect and deliver “Taxpayer Proxies” demanding the bank fire CEO Ken Lewis and commit to financial reform that puts consumers and workers ahead of profits.

The taxpayer actions took place on the eve of Bank of America’s annual shareholder meeting in Charlotte, NC. After accepting billion in bailout funds, taxpayers and the government are the largest shareholders of Bank of America, and taxpayers in Seattle are demanding that their voices be heard.

On April 29th a delegation of community and national leaders will deliver the “Taxpayer Proxy” demands to the Bank of America shareholder meeting calling on it to: fire CEO Ken Lewis; support strong banking reform; eliminate predatory lending practices and unreasonable fees; support the Employee Free Choice Act to ensure workers have a voice to speak out for consumers and improve working conditions; and provide affordable healthcare to bank workers so they are not forced to rely on tax-payer funded public health programs.

“Taxpayers didn’t cause this economic crisis—but we sure are paying the price," said SanJerra Collins, a caregiver from Tacoma and member of SEIU Healthcare 775NW. “For years, banks have built a business model around pushing dangerous products and burying customers in more and more debt. It’s time for banks to stop these predatory practices and create a system that’s about helping people, not exploiting people.”

Over the last two years, Bank of America CEO Ken Lewis has received .8 million in compensation, while the median wage for a teller at Bank of America hovers around the federal poverty line for a family of four.

Despite receiving billion in federal taxpayer bailout funds since last fall, Bank of America has announced plans to lay off 30,000 to 35,000 workers and handed out .2 million in corporate bonuses. Bank of America could have used the money they paid out in bonuses to give each of its bank tellers an estimated 1,000 raise—nearly seven times their median salary.

The bank also continues to make taxpayers pick up the tab for approximately million a year in employee health care costs because many Bank of America workers cannot afford the company’s health insurance and must rely on public healthcare programs. This costs Washington state taxpayers 9,000 every year.

Last year, Bank of America collected .3 billion in bank fees, almost 30 percent higher than either of its two largest competitors. And even after taking bailout money Bank of America continues running up credit card interest rates on customers even if they have made every payment on time. The bank arbitrarily hiked interest rates on one million play-by-the-rules, pay-on-time customers in 2007 alone.

In 2008, Bank of America spent over million on lobbying and opposed bills like the Employee Free Choice Act, the Credit Cardholders Bill of Rights and the Foreclosure Prevention Act which would directly benefit the economy and consumers.

For more information, please visit www.TakeBackTheEconomy.org.

###

SEIU Locals in Washington State

include:

SEIU Local 6 – representing 3,500 janitors and security guards

SEIU Local 49 – representing 1,200 health care workers in SW Washington

SEIU Healthcare 775NW – representing 35,000 long-term care workers

SEIU 925 – representing 23,000 education and child care workers

SEIU Healthcare 1199NW – representing 22,000 nurses and healthcare workers

SEIU Local 1948 – representing 27,000 school employees

Bank of America - Take Back the Economy 4-28-09 (22)

Image by seiuhealthcare775nw

Photo Credit: Neil Parekh / SEIU Healthcare 775NW

Seattle Taxpayers Demonstrate at Bank of America as Part of Continued Nationwide Actions to Take Back the Economy

“Taxpayer Proxy” Action Demands Bank Fire CEO Ken Lewis,

Commit to Strong Banking Reform, Voice for Workers

Seattle (April 28, 2009) – Taxpayers, working families and SEIU members joined together in Seattle today and more than 100 other cities across the nation today to take action outside Bank of America branches and collect and deliver “Taxpayer Proxies” demanding the bank fire CEO Ken Lewis and commit to financial reform that puts consumers and workers ahead of profits.

The taxpayer actions took place on the eve of Bank of America’s annual shareholder meeting in Charlotte, NC. After accepting billion in bailout funds, taxpayers and the government are the largest shareholders of Bank of America, and taxpayers in Seattle are demanding that their voices be heard.

On April 29th a delegation of community and national leaders will deliver the “Taxpayer Proxy” demands to the Bank of America shareholder meeting calling on it to: fire CEO Ken Lewis; support strong banking reform; eliminate predatory lending practices and unreasonable fees; support the Employee Free Choice Act to ensure workers have a voice to speak out for consumers and improve working conditions; and provide affordable healthcare to bank workers so they are not forced to rely on tax-payer funded public health programs.

“Taxpayers didn’t cause this economic crisis—but we sure are paying the price," said SanJerra Collins, a caregiver from Tacoma and member of SEIU Healthcare 775NW. “For years, banks have built a business model around pushing dangerous products and burying customers in more and more debt. It’s time for banks to stop these predatory practices and create a system that’s about helping people, not exploiting people.”

Over the last two years, Bank of America CEO Ken Lewis has received .8 million in compensation, while the median wage for a teller at Bank of America hovers around the federal poverty line for a family of four.

Despite receiving billion in federal taxpayer bailout funds since last fall, Bank of America has announced plans to lay off 30,000 to 35,000 workers and handed out .2 million in corporate bonuses. Bank of America could have used the money they paid out in bonuses to give each of its bank tellers an estimated 1,000 raise—nearly seven times their median salary.

The bank also continues to make taxpayers pick up the tab for approximately million a year in employee health care costs because many Bank of America workers cannot afford the company’s health insurance and must rely on public healthcare programs. This costs Washington state taxpayers 9,000 every year.

Last year, Bank of America collected .3 billion in bank fees, almost 30 percent higher than either of its two largest competitors. And even after taking bailout money Bank of America continues running up credit card interest rates on customers even if they have made every payment on time. The bank arbitrarily hiked interest rates on one million play-by-the-rules, pay-on-time customers in 2007 alone.

In 2008, Bank of America spent over million on lobbying and opposed bills like the Employee Free Choice Act, the Credit Cardholders Bill of Rights and the Foreclosure Prevention Act which would directly benefit the economy and consumers.

For more information, please visit www.TakeBackTheEconomy.org.

###

SEIU Locals in Washington State

include:

SEIU Local 6 – representing 3,500 janitors and security guards

SEIU Local 49 – representing 1,200 health care workers in SW Washington

SEIU Healthcare 775NW – representing 35,000 long-term care workers

SEIU 925 – representing 23,000 education and child care workers

SEIU Healthcare 1199NW – representing 22,000 nurses and healthcare workers

SEIU Local 1948 – representing 27,000 school employees